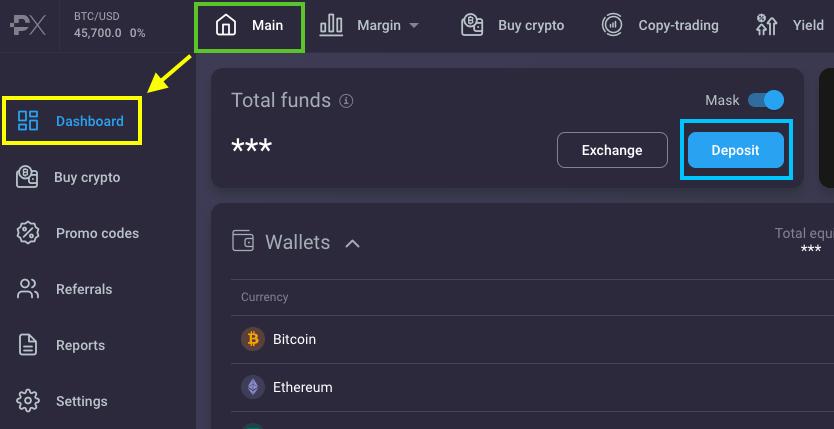

As the cryptocurrency market continues to evolve, many investors are keenly observing the performance of various digital assets. Among them, Polkadot (DOT) has garnered significant attention due to its unique technology and ecosystem. In this article, we will provide a comprehensive analysis of the factors influencing Polkadot’s price and offer a polkadot price prediction primexbt PrimeXBT deposit bonus for those looking to dive into this dynamic market. Additionally, we will present our price prediction for DOT and discuss what the future might hold for this innovative blockchain platform.

Understanding Polkadot

Polkadot is a multi-chain blockchain platform that facilitates the interoperability of different blockchains. Launched by Ethereum co-founder Dr. Gavin Wood, Polkadot aims to create a more connected and scalable blockchain ecosystem. Its unique architecture allows for various blockchains, referred to as parachains, to operate seamlessly within its network. This feature not only enhances scalability but also encourages collaboration among different projects.

Market Performance Overview

Since its inception, DOT has experienced significant price fluctuations. Investors have witnessed rapid price increases followed by corrections, typical of the volatile cryptocurrency market. The sentiment surrounding Polkadot often correlates with broader market trends, regulatory news, and technological advancements. For instance, when major upgrades or new parachains are launched, DOT’s price often sees a bullish reaction.

Factors Affecting Polkadot’s Price

Several factors can impact the price of Polkadot. Understanding these can help investors make informed decisions. Here are some key considerations:

1. Adoption and Use Cases

The more projects that adopt Polkadot to build their applications, the higher the demand for DOT tokens may become. Real-world use cases, particularly in decentralized finance (DeFi) and non-fungible tokens (NFTs), drive interest in the platform.

2. Network Upgrades

Polkadot undergoes regular upgrades that enhance its functionality and security. Upgrades like the introduction of new parachains or governance improvements can positively influence investor sentiment, leading to price increases.

3. Market Sentiment

As with any cryptocurrency, investor sentiment plays a crucial role in determining short-term price movements. Positive news coverage, endorsements by influential figures, or social media trends can lead to sudden price spikes.

4. Regulatory Environment

Regulatory changes can significantly influence the cryptocurrency market, including Polkadot. Positive regulatory developments can increase confidence among investors, while adverse regulations can lead to price declines.

Price Predictions for Polkadot

Forecasting the price of Polkadot involves analyzing current trends, market sentiment, and potential adoption rates. Based on recent performance and expert analysis, several price predictions have emerged.

Short-Term Prediction

In the short term, many analysts believe that Polkadot has the potential to reach a price range of $10 to $15 within the next 6 to 12 months, provided the cryptocurrency market remains bullish. If market conditions improve and adoptions increase, DOT could surge even higher.

Long-Term Prediction

Looking further ahead, some experts predict that DOT could see prices exceeding $30 to $50 over the next few years. This outlook is based on the assumption that Polkadot will continue to expand its ecosystem, attract more developers, and maintain a competitive edge over other blockchain platforms.

Investment Strategies for Polkadot

Investing in Polkadot requires a careful strategy, particularly given the market’s volatility. Here are a few strategies that investors might consider:

1. Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of the price of DOT. This strategy can mitigate the impact of volatility and reduce the risk of making large investments at unfavorable prices.

2. HODLing

Long-term investors may choose to hold onto their DOT tokens, believing in Polkadot’s long-term value proposition. This strategy relies on faith in the technology and market’s future.

3. Active Trading

For experienced traders, taking advantage of short-term price movements through trading could yield profits. This strategy requires a good understanding of market analysis and trends.

Conclusion

Polkadot presents a promising opportunity in the cryptocurrency landscape, thanks to its innovative approach to interoperability and scalability. While the market remains unpredictable, understanding the factors at play and adopting sound investment strategies can help investors navigate the complexities of investing in DOT. With our PrimeXBT deposit bonus, users can explore the possibilities of trading Polkadot and other cryptocurrencies with enhanced advantages. As always, investors should conduct thorough research and consider their risk tolerance before entering the market.

Leave a Reply